-

What are Futures?

A futures contract is an agreement to buy or sell a specific asset at a future date. Both buyers and sellers determine the forward price level, which is known as the forward price. The specified date of the future payment is known as the expiration date.

-

Are Futures traded on margin?

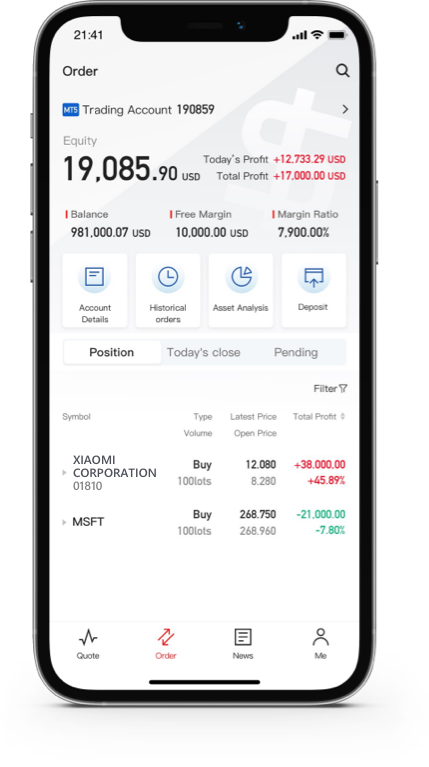

Yes, they are. Investors require a certain percentage of the contract value (margin ratio below 50%, usually around 10%) for the initial margin to trade.

-

How do I start trading Future CFDs?

Register with Doo Financial, verify your profile and download the MT5 trading platform to get started.

-

What factors affect Futures prices?

Futures prices are influenced by various factors, including supply and demand dynamics, geopolitical events, economic indicators, weather conditions (for commodities), interest rates, and investor sentiment.

-

What is leverage in Futures trading?

Leverage allows traders to control larger positions with a smaller amount of capital. It magnifies both profits and losses, so it's important to use leverage cautiously and implement proper risk management strategies.